golden state tax credit

Strongsilence-CPA The question was about a California Stimulus. Check if you qualify for the Golden State Stimulus II To qualify you must have.

California Stimulus Golden State First Checks Coming This Week Marca

Business Income Loss Sch C.

. Once approved by the IRS the RD credit is applied towards your businesss future payroll tax liabilities - so you can claim this credit. Golden State Stimulus I. The MCC remains in effect for the life of the mortgage loan so long as the home remains as principal residence.

California will provide the Golden State Stimulus II GSS II payment to families and individuals who qualify. Then you may be able to claim a sizable tax credit of up to 250000 or more. Since July payments have been coming in the form.

Golden State Tax Training Institute - Speciallizing in continuing education CE for California Tax professionals since 1983. Line 17 on Form 540. Mon-Sun Open til 600pm.

The child tax credit is a benefit available to all families regardless of how little money they make even if they do not ordinarily file taxes. The second round of Californias Golden State Stimulus program for example provided residents with 81million payments worth more than 58billion a spokesperson for the California Franchise Tax Board told The Sun. RD Tax Credits Claim the RD tax credit without the hassle.

The ERTC program is a refundable tax credit for business owners in 2020 and 2021. Eligibility is based on your 2020 tax return the one you file in 2021. This payment is different than the Golden State Stimulus I GSS I.

Self Employed Show sub menu. You can repay the excess during the 2022 tax filing season when you file a return for 2021. Why Did I Recieve Form 1098T.

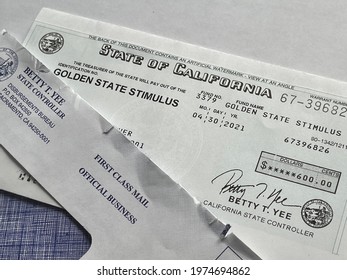

Enter your zip code to find a lender near you find a lender. Starting in mid-2021 through the Advance Child Tax Credit families who claim the Child Tax Credit received monthly deposits or paper checks directly from the IRS. Taxes are due soon and IHSS providers may qualify for a 600 or 1200 tax credit through the Golden State Stimulus.

IRS Show sub menu. 20 hour continuing education is our specialty. This is a one-time 600 or 1200 payment per tax return.

September 20 2021 817 AM. The MCC rate for the GSFA MCC Program is 20 so 20 of the annual mortgage interest paid can be taken as a tax credit. We are an IRS Approved and CTEC Approved Provider of continuing education and qualifying educationCE and QE.

Modeled off of the Federal EITC it is one of the most effective tools for addressing poverty as it helps people afford basic necessities like rent groceries and transportation. The remaining 80 of mortgage interest paid can still be taken as an itemized tax deduction 1. Education Show sub menu.

Taxes are due soon and IHSS providers may qualify for a 600 or 1200 tax credit through the Golden State Stimulus. In 2020 a credit is available up to 5000 per employee from 31220-123120 by an eligible employer. About The California Earned Income Tax Credit CalEITC is a refundable tax credit that puts money back in the pockets of low-income working people.

Golden State Stimulus II. Families claiming the CTC received up to half of the 3000 per qualifying child between the ages of 6 and 17 and 3600 per. California has signed the Golden State Stimulus which includes 600-1200 cash payments to eligible residents.

Tuition Fees Deduction. Below we explain whether these stimulus checks are subject to taxation upon filing a return in 2022. You will need to file your 2020 California state tax return by October 15 2021 in order to receive your California stimulus check.

Golden State Tax Training Institute Inc. What is Form 1099K. Michael Burrell Getty ImagesiStockphoto.

The deadline is May 17th for providers who are eligible to file for this credit. While the Golden State caps its tax credit at 660 million and offers an incentive of 20 to 25 percent of expenses a few other states offer generous terms as well. Modeled off of the Federal EITC it is one of the most effective tools for addressing poverty as it helps people afford basic necessities like rent groceries and transportation.

Child Tax Credit Golden State Money Was Sent Out Find Out Where Yours Is. We focus on customer service and satisfaction. Eligibility is based on your 2020 tax return the one you file in 2021.

About Golden State Tax Training Institute. Up to 26000 per W2 Employee. Live-in providers whose wages are exempt from taxes may qualify by using their last paystub of the 2020 tax year.

Taxes are due soon and IHSS providers may qualify for a 600 or 1200 tax credit through the Golden State Stimulus. IRS Tax Guide 2020. CTEC courses are offered online and highly popular book form.

Serving Utah with loans for your auto and home plus other financial and insurance products. Gig Worker Filing Guide. Filed your 2020 taxes by October 15 2021.

We provide high quality and cost effective courses for Tax Professionals since 1983. IHSS providers may be eligible for 1200 tax credit. Spidell offer very informative classes and are very popular with CA tax preparers.

This is copyright material from Spidell. And in September eligible California residents will receive the. Families of more than 60 million children received the first check from the advance child tax credit today.

In 2021 the Child Tax Credit was increased thanks to the American Rescue Plan. We strive to look for new and responsive ways to make your. What is Form 1099 NEC.

Has been approved by the California Tax Education Council to offer continuing education courses that count as credit towards the annual continuing education requirement imposed by the State of California for CTEC Registered Tax Preparers. American Opportunity Tax Credit. Does your business incur research and development costs in the US.

The stimulus is taken as a tax credit on the 2021 return.

Golden State Stimulus Ii How To Get More Payments In 2022 Marca

Still Waiting On Golden State Stimulus Check 784 000 Are Coming California Says

Caleitc4me Golden State Opportunity

Still Waiting On Golden State Stimulus Check 784 000 Are Coming California Says

Fourth Stimulus Check News Summary 18 January 2022 As Com

California Stimulus How To Track Golden State Payments Marca

Golden State Opportunity Gsopportunity Twitter

Fourth Stimulus Check Update Deadline Approaching For 1 400 Payment

600 For Ssi Ssp Recipients Is Approved In New Golden State Stimulus Package

Golden State Stimulus I Ftb Ca Gov

More Than 800 000 California Golden State Stimulus Checks Worth 575million Going Out Now Will You Get Up To 1 100

Golden State Stimulus Update Date Amount And Eligibility Marca

Los Angeles May 12th 2021 Close Stock Photo Edit Now 1974694862

Most California Golden State Stimulus Direct Deposit Payments To Be Issued By Oct 31

Golden State Fourth Stimulus Checks Worth 1 100 Sent Out This Week In California Here S When Yours Will Arrive

Can I Receive A Second Golden State Stimulus In California If I Got The First Payment As Com

Golden State Fourth Stimulus Checks Worth 1 100 Sent Out This Week In California Here S When Yours Will Arrive

Are Californians Getting Another Stimulus Check The New York Times

.png)